General Electric (GE) has taken a marked step to position itself in the global fight against climate change, advocating for immediate and effective power sector decarbonization through a replacement of coal-fired power generation with a combination of renewables and natural gas-fired power.

The company laid out its position on Dec. 15 in a wide-ranging white paper that explores multiple technical pathways through which the power sector could achieve a lower-carbon generating footprint. The pathways weigh the readiness, market suitability, and costs associated with several power-generating technologies, including for wind and solar, gas and liquid fuels, coal, nuclear, and battery storage.

Launch of the white paper signifies a definitive new direction for the American technology giant, a legacy brand in the global power space that has developed and deployed several generations of gas and steam turbines and related power plant equipment since 1901.

As several GE executives told POWER, formalizing GE’s position on how to address climate change gives it the opportunity to assume a “key role” in converging stakeholder action on climate change, including by governments and its customers. GE is suited to the role because it is “uniquely positioned” on the issue, owing “to its scale, breadth, and technological depth” across a broad array of complementary technologies that make up its product and services portfolio, including gas power, onshore and offshore wind, hydropower, small modular reactors, battery storage, hybrids and grid solutions, and digitalization, they said.

Stage Set for Immediate Action

In the paper, “Accelerated Growth of Renewables and Gas Power Can Rapidly Change the Trajectory on Climate Change,” GE argues that immediate action is warranted to achieve climate change mitigation. However, decarbonization of the power sector—which it defines as “the reduction of carbon emissions on a kilogram per MWh basis”—and electrification of energy use sectors is “mired in defining and debating an ideal future state and the timeline by which society would achieve that end-state.” With each passing day, “insufficient” global progress is being made to address the energy trilemma of affordable, reliable and sustainable energy, it says.

It concludes that even as efforts continue to advance technologies for low or near zero-carbon power generation, the world should quickly and strategically deploy a combination of renewables and gas power—a concept it terms “renewables + gas power”—as the “most effective near-term actions” to decarbonize the energy sector.

Among the paper’s key findings are that despite positive cost drivers for renewables and a surge of recent installations, “increases are not occurring at the pace or scale needed to decarbonize the power sector and meet the goals of the Paris Agreement.” And despite great strides in capital expenditure (CAPEX) reductions for lithium-ion batteries, battery storage will not be competitive on a levelized cost of storage basis for durations greater than eight hours without a significant technology breakthrough.

Meanwhile, despite the mass of coal plant retirements and a slowdown in finance for new coal plants, nearly 2,000 GW of coal plants will still be operational at the end of the decade. Nuclear remains an important carbon-free resource, but though forecasts show around 10 GW per year of future demand for new nuclear, the timing remains uncertain, it says.

Renewables and gas power have the “capability to quickly make meaningful and long-lasting reductions to CO2 emissions from the power sector,” but neither will be as effective alone at decarbonization at the pace and scale necessary to avoid raising average global temperatures by less than 2 degrees Celsius, it says.

The position paper also concludes that solving the climate challenge power sector decarbonization will require broad cooperation across national boundaries, economic sectors, and the political spectrum.

In addition, GE offers a series of recommendations for the power industry. Along with urging stakeholders to invest in a combination of wind, solar, batteries, and gas-fired power “at scale with urgency,” it calls for incentive mechanisms and increased funding in research and development to help further tamp down costs for renewables and hybrid-storage technologies.

It also encourages investments that will enable future cost and technology breakthroughs, for example, to make hydrogen competitive as a zero-carbon dispatchable fuel, and to enable carbon capture, utilization, and storage (CCUS) as an economic option.

Definitive Direction

GE’s position on decarbonization is not wholly unexpected, but the white paper, which outlines a complementary role for its core gas power business, is notable.

Despite a series of setbacks stemming from slack market demand, the company today still holds a steady share of the highly competitive gas turbine market. In recent months, it has ramped up efforts to find holistic opportunities and niche applications for its gas turbines in the emerging low-carbon power space.

In August, the company’s Gas Power division, for example, agreed to roll out a detailed decarbonization roadmap that may entail hydrogen-friendly upgrades to all GE gas turbines and compressors at Uniper’s gas power plants and gas storage facilities across Europe. In September, GE made the stunning decision it would exit new-build coal power projects “subject to applicable consultation requirements,” but it said it would continue “to focus on and invest in its core renewable energy and power generation businesses, working to make electricity more affordable, reliable, accessible, and sustainable.”

Also in September, GE joined the Low-Carbon Resources Initiative (LCRI), a five-year initiative jointly spearheaded by nonprofit research groups Electric Power Research Institute and the Gas Technology Institute to identify and accelerate fundamental technologies options and potential pathways to a low-carbon future. And in October, the company announced a broader commitment to achieve carbon neutrality for its own operations by 2030.

Asked if GE views the white paper as a vision for how it will direct future business, Brian Gutknecht, GE Gas Power’s chief marketing officer, told POWER, “I would say it’s even bigger than that. I think about this decade of action that GE is going to take, but also that countries need to take in terms of shaping the right policy to help this, that our customers are actively taking today—and that it’s the decade of action for all of us.”

Industry Seeking Direction

Gutknecht said GE formalized its position with the white paper after receiving repeated inquiries from customers from 26 countries around the world, even some it is not engaged in, about input on potential decarbonization journeys.

Spearheading GE’s efforts is Dr. Jeffrey Goldmeer, an expert on hydrogen technologies who formerly led the division’s fuel flexibility efforts and now heads up GE Gas Power’s Emerging Technologies division. Goldmeer told POWER that GE’s customers are generally looking to plan ahead. Customers are saying, “We’re going to adopt a decarbonization roadmap, we’ve made an [environmental, social, governance (ESG)] commitment of our own around carbon reduction, and GE, we want your help as we develop that roadmap. We want your feedback. We want you to partner with us because we have GE equipment,” he said.

Some of those efforts have developed into actual projects. In October, the Long Ridge Energy Terminal announced it would transition its 485-MW combined cycle power plant in Ohio to run on a hydrogen blend when it begins operation in 2021. Other projects, which GE has not made public, are also underway, Goldmeer said. “To me that’s really the barometer here, that we’re not just seeing inquiries, we have customers taking concrete steps in this space. And it’s not just in the U.S., it’s all over the world we’re seeing them,” he said.

One reason for the heightened action in decarbonization action is to reduce risk under ESG criteria, which has quickly evolved over the past few years into a central measure that an increasing number of of utilities, investors, and corporations have adopted to gauge corporate performance, risks, and progress toward sustainability targets.

“Our customers are thinking about this as de-risking the investments they’re making,” particularly in longer-term investments like power plants, Goldmeer explained. “Part of the risk is what happens in the future in terms of policy and such, and they’re looking for us to help them de-risk it by knowing the technology they’re buying within a gas turbine plant. There’s a pathway forward that they’re not locked in, and they’re looking to us for assurance that there is a technology path.”

A Business Opportunity

But a formal position on decarbonization also opens up potentially lucrative business opportunities and new markets, as Scott Strazik, CEO of GE Gas Power, told POWER. “I think we know there’s going to be real demand in electricity over the next three decades. We see 50% to 60% electricity growth” stemming from electrification of mobility, the heating, and parts of the world that don’t have access to power, he said. Part of the opportunity stems from the near-certainty that renewables cannot fill the gap alone, he said.

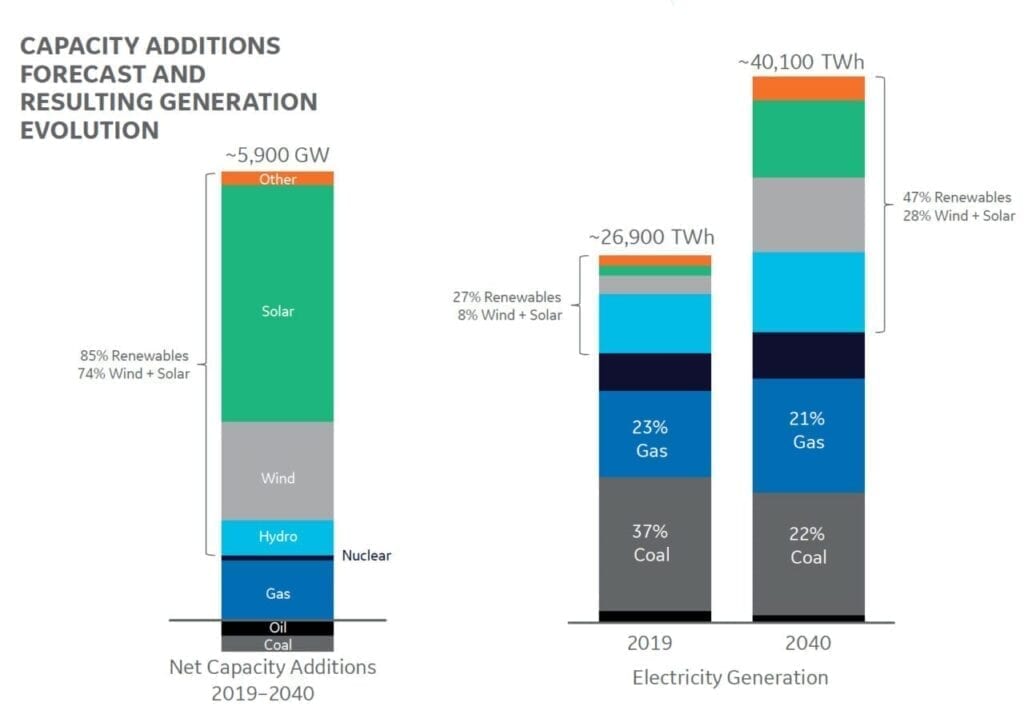

Citing the International Energy Agency’s (IEA’s) World Energy Outlook 2020 report, GE’s paper points out that in 2019—an unprecedented year for renewables orders—200 GW of renewable power was installed, pushing up renewables’ share of the global generation mix to 27%. By 2040, with solar PV capacity is slated to grow by about six times to more than 3,600 GW, and wind capacity by about three times to 1,900 GW, renewables may account for 47% of the total global electricity supply.

In 2040, meanwhile, about 22% of the world’s power will come from coal generation and 22% from gas. “We want to grow the renewables market as fast and practically as we can, where that makes sense, but there’s a massive CAPEX spend of $200 billion a year being spent right now, really growing the renewables penetration by only 1% globally with every $200 billion,” Strazik said.

Net capacity additions and resulting change in electricity generation (2019 to 2040).

Despite massive renewables investment, coal generation is projected to fall only around 10%while gas generation is projected to grow around 33% through 2040.

Source: GE/IEA World Energy Outlook 2020 Stated Policies Scenario

Opportunities also lay in addressing intermittency risks posed by variable renewables, he said. One example is a deal GE announced last week with RWE Generation for 11 units of its LM2500XPRESS power plant technology to provide a critical gas-power reserve in Germany’s reliability-challenged southern region.

Gas power offers several other benefits, including that it requires less land per unit of installed generating capacity, and it can be deployed more quickly than any other form of dispatchable utility-scale power, Strazik noted.

Those attributes make gas well-suited to a variety of markets. “Power density in the U.S. is especially important, and we’ve had a huge surge of gas over the past decade from shale gas. When liquefied natural gas (LNG) becomes that much more available, especially when it ships from the U.S., Australia, and Qatar to Asia, we’re looking at a lot of new additions in Asia over the coming decade. In the meantime, even with the pandemic, we’ve seen a very resilient performance of the installed base and can expect to see that for the foreseeable future,” he said. So even if the operating profile of gas is changing, “[gas plants] are still playing a meaningful role in the energy transition,” he said.

Asked about potential market challenges GE considered as it drew up its position, Vic Abate, GE senior vice president and chief technology officer (and former CEO of both GE’s Gas Power and Renewables businesses) also pointed to the massive capital necessary to enable decarbonization via a renewables-only scenario. “When you look at the amount of capital we have, and in our models, we looked out through 2050, deploying $10 trillion in renewables, you still have a gap roughly a third of the electricity the world needs, if there’s no fossil fuels,” he said.

“That gap is twice what the gas fleet is today. So the reality is, that’s why it’s renewables plus gas, as we see it, but also the grid. There’s a lot of challenges with the grid. Very efficient CAPEX of gas, positioned properly in the various grids, can make that investment much more capable, versus the need to retool it in its entirety,” said Abate.

Promise of Technology Innovation

Another wildcard could stem from a breakthrough in technology development. Among “disruptive technologies” Goldmeer said GE is watching are innovations in electrolysis technologies for hydrogen production. “We’re looking at methane pyrolysis, and a lot of other alternative kind of electrolysis technologies, where there’s a potential promise of lower cost because its less energy input. To me, it’s what are the disruptors that could bring the price of hydrogen down sooner and bring that cost curve down even faster and having more hydrogen available at lower cost sooner.”

Abate also highlighted several promising technologies, but suggested that to better understand a technology’s impact on decarbonization, it is useful to think about the suitability in development timeframes. “[For wind and solar] near-field, it’s about cost. Midfield, it’s about hybridization and storage, and the control systems there, and in far-field, the question is can you enter more markets beyond electricity using hydrogen and decarbonize other sectors?” he said. Dispatchable nuclear, too, could play a role in decarbonization of transportation and industry using hydrogen, but advancements are in the future.

That’s why, Abate explained, GE is especially excited for gas. “In the near-field, it’s one-third, roughly, the emissions of the installed base for coal. Over the mid-term, our gas turbines and the world’s gas turbines for the most part can run on doping hydrogen [using a hydrogen/natural gas mix],” he said. “In the far-field will be carbon capture and sequestering, as well as 100% hydrogen for gas plants.”

As Gutknecht pointed out, one way GE is preparing its gas power fleet to compete in the ever-changing power market is through technology advancement. With more renewables online, “there’s clearly this recognition that the gas plants are going to become more and more cyclic and need to have more and more flexibility, so we continue to invest not only in the flexibility of the new plants that are being built, but ensuring that we can roll as much of that flexibility into this existing installed base.” Efforts, for instance, involve “looking at things like extending how low we can turn down load,” he said.

Policy Question

Gutknecht, stressed, however, that the position paper is intended to make a difference now. “We believe we have to move the needle now, not by 2050, but with the urgency and substantive steps now to really make this a decade of change,” he said. “And the good news is we don’t have to wait. Right now we have the capability and the technologies to do this.”

What’s missing, he said, is the policy component. Rather than suggest policies on a regional basis, Gutknecht said GE has distilled its decarbonization policy wishlist into four key criteria.

“The first is focused on incentivizing lowering carbon intensity,” he said. “So, the grams per kilowatt hour—can we continue to squeeze that down more and more. I say that because as electricity as a segment continues to grow, we just need to make sure our intensity is shrinking.” The second criteria urges policymakers to ensure markets structures value energy, flexibility, and dependable capacity. That will “make sure that we decarbonize but also keep an eye to protecting the security and the dependability of our grids,” said Gutknecht.

The third criteria, which Gutknecht characterized as the “most important,” is to set realistic timelines for reduction efforts, with periodic reviews as science and technology improves. While net-zero ambitions are valuable, it’s “equally or maybe more important to say, ‘what are my year over year goals,’ and make sure that policies are incentivizing that, because I’m afraid that too many policies today have this view of, ‘Well, we’ll draw a line in the sand and say 2050, and somehow we get there,’ but we don’t make enough progress year on year.”

The last criteria is to ensure policies are transparent and predictable, allowing lifecycle economics to drive investment decisions. Policies should focus “on the right outcomes,” Gutknecht said.

“If that outcome is to help address climate change, then focus on greenhouse gas emissions, as opposed to explicit mandates that certain countries or states may put in place, which may not actually achieve the desired outcome of addressing climate change,” he said.

—Sonal Patel is a POWER senior associate editor (@sonalcpatel, @POWERmagazine).

0 Comments Leave a comment